Category: Car Accidents

Here is what the Insurance Companies Don’t WANT YOU to Know!

Have you been the victim in a personal injury accident and are now looking at negotiating with the insurance company involved to attempt to secure compensation? If so, you should take a moment and seriously consider hiring professional help. The fact of the matter is that insurance companies will exhaust any and all possible angles to reduce the amount of money they have to pay you. In order to understand exactly why this is the case, and why legal counsel is your best option, let’s take a look at a few of the more pertinent and less obvious reasons that insurance companies have for avoiding settling with victims.

Revenue Source

First of all, don’t make the mistake of believing that your premium is the main way that insurance companies make their income. In reality, they earn the vast majority of their money through investment. That means that they have large sums of money held up in different investment options and earn more the longer they have it in place. Additionally, interest payments can different greatly depending upon the amount of money in question – in general, you earn more money in interest the more money you have invested.

This is one of the main reasons that insurance companies fight notoriously hard to avoid paying victims compensation. When they part with large sums of money, they lose their main income source. In fact, they stand to lose far more than they pay out. If they lose a particularly large sum of money, for example, market prices could be negatively affected. This could impact their investments, not to mention the fact that they suddenly have a much smaller amount of money upon which to earn interest.

Attorneys Can Help

Most insurance companies are far more likely to settle with victims who have hired legal aid. Note that for this reason, they will go to great lengths to discourage you from hiring an attorney. The reason for this is simple: as explored above, insurance companies stand to lose big time if they pay out large settlements. Attorneys are better able to secure those large settlements because they understand exactly how the insurance company works and can better anticipate their manipulative tactics than other individuals can.

Delay and Deny

Remember the section above where we learned that insurance companies make most of their money from investments and the interest they earn from them? Well, welcome to yet another reason to hire an attorney. Insurance companies will go out of their way to delay paying a settlement, and that’s especially true if the case in question is likely to win. They have more to lose than you do and will therefore expend a lot of effort to delay the payment as long as possible in order to continue to earn interest on the money in question for as long as they can. Additionally, they often flatly deny claims that have a great chance of winning in court because it forces victims to seek legal aid. This takes them more time and effort, allowing the insurance company to keep the sum in question a little bit longer.

Hiring an attorney from the get-go, of course, is a great way to avoid this game as much as possible.

You’re on Candid Camera

Maybe you’re not convinced that an attorney is necessary. The adjustor you’re speaking with seems very nice, after all, and they’re happy to take a lot of time out of their day to discuss the problems you’re experiencing in detail. That must mean that they truly understand how much you need the compensation in question in order to recover, right?

Well, no, as it turns out. In fact, adjusters are trained to record absolutely everything you say and do during negotiations so that they have more material to work with when it comes to discrediting you and lowering the amount of money they have to pay out. Do not forget that you are being recorded and that everything you say and do will be used against you. This is the main reason attorneys will instruct you not to speak with an adjuster until you’ve met with them.

Be Suspicious of Quick Claims

Everything we’ve discussed until now has talked about just how advantageous it is for insurance companies to deny your claims and drag out the process. If your insurance company is all too eager to settle, then, you should take some time and think about why. Why would they be willing to give you money right away when they could force you to go to court and make money in the meantime?

If you have a particularly great claim and they could stand to lose a lot more than they’re offering you if they go to court, you might be surprised at just how quickly they settle.

Insurance companies aren’t interested in what is best for you. They don’t care about your needs or your injuries. Their focus is on making and keeping money. For that reason, you should reach out to experienced personal injury attorneys for help immediately if you are facing a personal injury claim. The lawyers at Frederick and Hagle can help. Call 217-367-6092 today for a Free Consultation.

Auto Accidents and Private Property: Who is at Fault?

Automobile accidents are incredibly serious issues that can have catastrophic consequences. This is as true of accidents that occur on private property as it is of accidents that occur on a public thoroughfare. That is not to say that the two don’t have any differences at all, of course. Determining who is responsible for the accident can be more difficult with accidents that occur on private property. It is important that you understand your rights during this difficult time and are able to determine who is liable for the accident.

Who is at-fault?

When someone drives or otherwise behaves negligently and leads to the damage of person or property, they might be held liable for the victim’s losses. This does not change when the accident takes place on private property. Note that this can encompass situations where the accident was not caused by another individual physically striking your vehicle. If a privately-owned parking lot fails to mark blind spots or to ensure that the proper number of “no stop” or “yield” signs are in place, for example, then they very well might be found liable for accidents that occur in the lot.

Depending upon the property owner in question, you might find that gathering information about your accident, including camera footage, if available, that shows you were not at fault, to be quite difficult. A property owner who has an active stake in ensuring that you (and not they) are found to be liable for your own damages, for example, is less likely to willingly help you prove that the accident was not your fault. That is where an experienced attorney familiar with the laws governing auto accidents and private property comes in handy.

Auto accidents can happen to anyone. Even the most cautious of drivers can find themselves caught off-guard and put into a bad situation. If you have been the victim of an automobile accident on private property, the attorneys at Frederick and Hagle can help. Our experienced legal experts understand how to determine who is at fault for accidents as well as how best to ensure you receive proper compensation.

Reach out to us today at 217-367-6092 for more information!

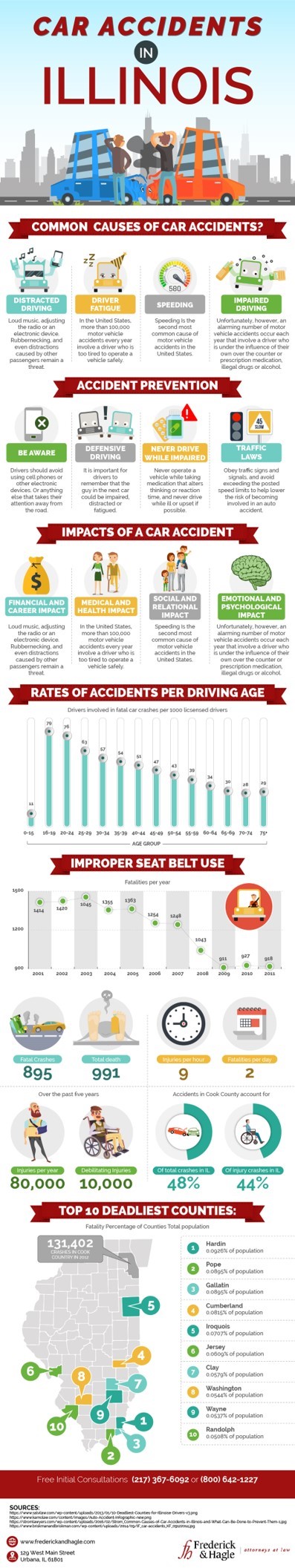

Common Causes of Motor Vehicle Accidents

Car accidents are a major cause of injury in the United States. In fact, they are probably far more common than anyone would like to admit, with 324,473 crashes and 93,160 injuries being reported in Illinois in 2016 alone. That’s nearly 1,000 crashes (and 10 injuries an hour) per day according to the Illinois Department of Transportation’s Illinois Roadway Crash Data. It’s not surprising, then, that even the most cautious and safest of drivers can end up involved in a serious car accident. Let’s take a look at some of the most common causes of motor vehicle accidents in Illinois.

Distracted Drivers

One of the main causes of accidents is distracted driving. This is any kind of driving where the driver is not fully engaged in driving. This includes a wide range of behaviors, including:

- Checking Social Media

- Interacting with Their Passengers

- Texting

- Reading a GPS App

- Writing

- Reading

- Driving While Emotional/Upset

- Driving While Fatigued

This kind of behavior is extremely risky and increases the changes of the driver causing (or being involved in) a motor vehicle accident.

Not Driving While Sober

Whether it’s under the influence of alcohol, prescription medication, or illegal drugs, driving while not sober is a big cause of motor vehicle accidents. There are many substances that can alter your judgment and perception and using them before driving is almost inviting a crash.

Driving Too Fast

Speeding is another big cause of car accidents. Frustration with posted speed limits is understandable in certain situations, however that doesn’t change the fact that adhering to them is safer than not. They were put in place for a reason. Failure to follow speeding restrictions can quickly end in a tragic situation.

Have you been the victim of a motor vehicle accident? The experts at Frederick & Hagle understand how difficult and overwhelming the situation can be. We’re ready to help fight for your rights and secure the compensation necessary to move on. Contact us today for more information!

Hurt in a Wreck? Seek the Compensation You Deserve with Our Auto Accident Lawyers

In 2016, the people of Illinois were involved in over 300,000 car accidents. About 20 percent, or 60,000, of these crashes resulted in a serious injury. And about 1 percent, or 1,000, of them ended in death. A mix of nasty winter weather and dense urban traffic make for a dangerous driving environment.

If you were involved in one of these accidents or any other accident, you need a car accident attorney in Illinois. Our car accident attorneys know the impact of even a small car accident and can help you get the relief you need.

Common causes of car accidents

Car accidents can happen for many reasons. Accidents can happen when two people are driving safely, but usually they occur because of one driver’s negligence. Here are some common reasons for accidents:

• Driving under the influence of drugs or alcohol

• Drowsy driving

• Distracted driving

• Disobeying traffic laws or signals

• Speeding

• Aggressive driving

• Bad weather

Also, here some common indicators of fault:

• Not stopping at a stop sign

• Backing out and hitting another car

• Driving without legally required glasses

• Driving without headlights on at night

• Driving distracted by texting, being on the phone, eating, etc.

• Driving under the influence of alcohol or other drugs.

If the other driver was doing any of these, it’s likely the accident is their fault legally. Of course, there are more factors that are considered when determining fault, but this is a good start.

If you had a car accident that was not your fault

The first thing people do after they get into a car accident that wasn’t their fault is hire an attorney. They almost always hire a local attorney: so, if you live in Champaign, you need an attorney in the Champaign area.

An attorney will help the process go much smoother for you and help you get the compensation you deserve. Here’s what our attorneys will do:

• Understand the accident to find out its cause

• Make it clear that the person who caused the accident is responsible for the accident

• Find the best source of compensation from insurance

• Learn about all your medical needs and recommend a doctor

• Count all your financial and non-financial losses

Our attorney’s will get the compensation you need for all your losses.

This process can be confusing for most people; an attorney will take care of the whole process and make it easy for you, but an example will clear up how the process works.

(Truck accident? Read this.)

Example

Jim gets in a car accident with Sally when Sally makes a left turn into the front left side of Jim’s vehicle. Jim had a green light and Sally had a green light for yield. The accident is Sally’s fault. Jim gets all of Sally’s contact information and goes to the hospital for serious back injuries. At the hospital Jim racks up $25,000 in medical bills; he goes to an attorney as soon as he gets out of the hospital. The attorney listens to the case and then determines the best source of compensation. Sally works a minimum wage job. But she has an insurance policy worth over $100,000. This is an important note, whether the attorney sues Sally or the insurance company, generally, Sally herself won’t pay the money, her insurance company will.

Jim’s attorney files a claim against Sally’s insurance company. Instead of taking the matter to court, the insurance company agrees to settle the matter for $35,000. If Jim had filed a claim without an attorney, the insurance company may have only given him $25,000 maximum because they would not have taken him as seriously. Jim didn’t pay the attorney anything upfront and only now that Jim gets paid does the attorney get paid: the attorney gets paid a percentage of the settlement amount.

This is a routine process. An insurance company will give a self-represented person less every time. Hire an attorney and the process is easier and you will be compensated with what you deserve.

How much is a car accident claim worth?

Here are some real car accidents that happened in Illinois and the real amount the plaintiff (the person suing) received.

Dislocated collarbone from car accident

When: 1992

Where: St. Clair County, Illinois

Facts: The plaintiff was 14 years old and driving with his mom. His mom turned left in front of another car — both with green lights — they collided. The plaintiff’s collarbone was dislocated and cost $1,100 in medical bills. Ultimately, the jury sided with the defendant, because the plaintiff was making the left turn, and the plaintiff got nothing.

Neck injury

When: 1992

Where: Madison County, Illinois

Facts: The plaintiff was driving and was rear-ended while stopping to turn right onto a small access road. The defendant was speeding. The accident caused neck bone, tissue, and nerve damage and resulted in $3,000 in medical bills and $500 in lost wages. It went before a jury and the jury awarded $6,720 to the plaintiff.

Death by head injury

When: 1994

Where: Cook County, Illinois

Facts: 28-year-old Hurley was driving down the road when a tractor-trailer pulled out in front of him. Hurley’s car went right under the trailer, tearing the roof from the car. He didn’t survive. His wife brought the lawsuit against the tractor-trailer company. The company settled the matter for $1.4 million.

If you or a loved one has been in a car accident, our car accident attorneys can help you recover the compensation you deserve, so that you can focus on your recovery. Contact our Champaign office to schedule a free, no obligation consultation with one of our qualified attorneys, and let us discuss the legal options that are available for your specific incident.

If we decide to take on your case, there are no upfront fees.

Call 1-800-642-1227 or fill out a Free Case Evaluation form today.

Pickup Truck Accidents are on the Rise in Illinois

In 2016, pickup trucks were involved in the second highest number of accidents after passenger cars, in Illinois. Altogether, there were over 63,000 vehicles involving trucks of all kinds — just in one year. Accidents with trucks are more dangerous than those between cars.

If you were involved in an accident with a truck, you need a truck accident attorney in Illinois. Our truck accident attorneys know the gravity of a truck accident and can help you get the relief you need.

(Read the official car accident report here.)

What causes truck accidents?

Truck accidents happen for all the same reasons as car accidents. But one thing is for sure: the person not driving the truck is the person in the most danger. Only 21 percent of the people injured in truck accidents were the people in the truck, 77 percent were in the other vehicle, usually a car. Also, only 3% of all accidents in Illinois involve large trucks, but 10% of deadly accidents are with large trucks.

Here are some common causes for large truck accidents in Illinois:

• Speeding – Illinois has more than the normal amount of accidents from speeding: 39 percent of deadly accidents in Illinois were from speeding, whereas the national average is 28 percent.

• Drowsy driving – truckers have a legal limit on how many hours they can drive a day. Sometimes they exceed that limit.

• Distracted driving – eating while driving is common among truckers. This could also include driving while texting, drinking, or talking on a cell phone.

• Driving under the influence – this could include alcohol of course, but also prescription drugs.

• Not enough driver training – sometimes trucking companies undertrain their drivers.

• Unrealistic delivery schedules – sometimes drivers are under the pressure of intense delivery schedules. This can lead to poor decisions and accidents.

(For more on car accidents, go here.)

Whose fault is a truck accident?

A “truck accident” can include anything from pick-up trucks to three-trailer semis. Oftentimes people use it to refer to an accident with a commercial tractor-trailer or semi. These accidents are unique because it involves more parties, or groups, that can be responsible. Parties include:

• You

• The truck driver

• The employer of the truck driver

• The maker of the truck

(Want to know what to do after an accident? Read this.)

How much is a truck accident claim worth?

Here are some real truck accidents that happened in Illinois and the real amount the plaintiff (the person suing) received.

Pelvic fracture caused by a truck accident

When: 1994

Where: Cook County, Illinois

Facts: This was a case of suing the wrong person. 18-year-old Williams sued the City of Evanston, claiming its truck had hit him while he was walking across the street. He then held onto the truck until one of the passengers kicked him off. Pretty messed up. But Williams’ license plate number he provided did not match any of the city vehicles. He piled up $5,400 in medical bills and the jury gave him nothing.

Leg fracture caused by a truck accident

When: 1991

Where: Cook County, Illinois

Facts: Kruse was driving when her vehicle was hit by a commercial truck. The company admitted fault and settled for $1.5 million. Kruse had multiple leg and facial fractures and scarring and had tallied $200 thousand in medical bills.

(Want to see our case results? Go here.)

Should I hire an attorney for my car accident?

When it comes to unexpected situations that can change a life forever, traffic accidents are among some of the most devastating around. Because they involve heavy, large machinery moving at fast speeds, it perhaps makes sense that the injuries traffic accidents inflict upon their victims are often catastrophic in nature. If you or someone you love has been injured in a car accident of some kind, it’s important to reach out to an experienced attorney who can help. With that said, you might be wondering exactly when you should hire an attorney. Let’s look at some of the considerations to undertake when making your decision.

Who is liable for the accident?

If the liability in your case is crystal clear, that can help the process move smoothly. In the event that the liability is shared or unclear, however, you might find yourself facing an uphill legal climb. This can be a serious issue, especially if you have medical bills or property damage to cover (not to mention lost wages if your injuries have left you unable to complete your normal shifts). Whether you are looking to secure your compensation or help ensure that the responsible person is held accountable, an attorney can help.

Insurance Has Offered (or Denied) a Claim

Insurance can be incredibly difficult to deal with. Keep in mind that their main interest is in ensuring that they keep as much money in their coffers as possible, not what is best for you. That means that they will do their best to pay out as little as they can if they offer a settlement. They will often deny a claim outright, leaving victims feeling as though there is no recourse. A lawyer can help you handle insurance claims and do their bests to secure the compensation you need to recover. If your claim has been denied – and even if you have been offered a settlement – you should hire an attorney.

You are Facing Extenuating Circumstances

Finally, if you are facing extenuating circumstances, you should reach out to an attorney for help. This means that if you are facing issues with lost wages or even problems with caring for loved ones after an injury from a car accident, a lawyer can help. Remember that insurance claims tend to calculate immediate losses, not complicated issues like lost work, caregiver fees, and extended projected medical fees. An expert can help make sure that you receive the compensation that you need to move on with your life.

Statute of Limitations

Something else to keep in mind when working through your traffic accident claim is the statute of limitations. You want to make sure that you understand how much time you must file a personal injury claim. In Illinois, this is generally within two years from the accident. Regardless, contacting an attorney can help you stay on top of any important due dates. It should be noted that a lawyer can also help protect you if you are concerned that someone might file a personal injury claim against you within the statute of limitations.

If you need help with your traffic accident personal injury case, the attorneys at Frederick & Hagle can help. We have the experience, knowledge, case history, support, and reputation needed to fight for your best interests. Contact us today for more information!

2018 Jeep Cherokee and Ford Explorer Receive “Poor” Safety Rating

The most recent Insurance Institute for Highway Safety (IIHS) crash test results for midsize SUVs are available, and both the 2018 Jeep Grand Cherokee and the 2018 Ford Explorer received a “Poor” rating, the lowest possible, in front-end collisions involving the right side of the vehicle. Officially called an “overlap crash,” the front-end crash tests found that injuries were more likely from collisions occurring at speeds of 40 mph or higher with both cars, specifically to the lower leg and foot for Jeep Grand Cherokee front passengers, and to the high and thigh area for Ford Explorer front seat passengers.

The information is significant, given that 4,000 front seat passengers died in a car accident in 2016. That accounts for 16% of all car accident victims that year.

The Ford Explorer had serious issues in front right end collisions, most notably the likelihood of the car to collapse inward onto the font passenger as the result of a front-end accident.

The Jeep Grand Cherokee’s passenger side air bag didn’t deploy during the crash test, and the passenger door popped open, leaving the passenger susceptible to serious head injuries.

Ford defended itself saying that they have redesigned their 2020 Explorer, which is expected to be commercially available in 2019. Jeep has also said they have recently redesigned the Grand Cherokee, but the release date is not yet available.

The Insurance Institute of Highway Safety’s scale ranks cars as either Good, Acceptable, Marginal, or Poor. This year, 3 midsize SUVs received a “good” rating, while 3 others received an “acceptable” rating. Out of 2018 midsize SUVs, none were found to be “marginal” in terms of crash test safety.

Good:

- GMC Acadia

- Kia Sorento

- Volkswagen Atlas

Acceptable:

- Honda Pilot

- Nissan Pathfinder

- Toyota Highlander

Marginal: NONE

Poor:

- Ford Explorer

- Jeep Grand Cherokee

If you or someone you love was a front seat passenger in a 2018 Jeep Grand Cherokee or 2018 Ford Explorer and have injuries resulting from a collision, please contact the car accident and injury attorneys of Frederick and Hagle. For nearly 30 years, our firm has successfully represented those who have been harmed as the result of car accidents stemming from reckless driving and faulty vehicles. Contact us now for a free consultation with one of our attorneys at 217-367-6092 or by completing our online case evaluation form.

Driving and Texting: Proving Fault

In the state of Illinois, it is illegal to text while driving. That is not to say that everyone follows the rules, of course, and that means that accidents caused by this easily avoidable issue continue to be a serious problem. Despite the rising knowledge and caution regarding just how dangerous texting and driving can be, it remains an issue that leads to thousands of injuries every year. And, unfortunately, this can be a difficult case to prove. If you have been injured in an accident with someone who was texting on their cellphone while driving, it’s time to reach out to an experienced attorney who understands how best to pursue these kinds of cases.

Find a Witness

For obvious reasons, it can be hard to definitively and convincingly claim that you saw the other driver on their cellphone right before the accident happened. Most people will assume that you were watching the road and had no idea what was happening. With that in mind, it becomes very important to find witnesses to the accident who can help corroborate your assertions. This is true even if all you can do is prove that the other driver was on their cellphone as opposed to definitely texting. This witness might be another driver, someone who was on the side of the road and saw the accident, or even a passenger in one of the vehicles involved.

Cameras and Evidence

Another potential resource at your disposal when it comes to proving that the other driver was texting and driving is via cameras. There are a few different scenarios that might yield this result. First of all, are there cameras in the area where the accident occurred? Look into the stores and businesses nearby as well as any street lights you passed. You might very well find that one or more cameras recorded the accident and show the other party texting on their phone. Additionally, don’t forget to check any potential dash cam footage that you might have. Depending upon the accident in question, it’s possible that you could have recorded the crime yourself (or, at the very least, might find potential witnesses who did).

Text Logs

This isn’t always a feasible option, but if possible, ask for text logs of the other driver. This can show timestamps that match your story about their texting and driving habits. Sometimes you might even receive correspondence from the person with whom the other driver was texting. Their word can do wonders for your case.

Social Media and Technology

Keep in mind that “texting” doesn’t always mean exchanging literal texts with someone. In fact, someone typing on their phone could very well be updating their social media accounts. Check profiles to see if you can find time stamps that would show the driver was online around the time of the accident.

If you have been involved in an accident, reach out to Frederick and Hagle, Attorneys at Law, for expert representation today!

Distracted Driving: The Dangers Driving and Texting

Driving is a serious responsibility that should not be taken lightly – and, when that responsibility is shirked, the responses can be devastating. This is one of the reasons why distracted driving is such a serious problem. Defined by the CDC as driving while engaging in any manual, cognitive, or visual activity that proves a distraction. To put it a bit more simply, distracted driving means doing anything that takes your mind or eyes off of the road or your hands from the steering wheel. Some more concrete examples of distracted driving include:

- Eating

- Talking on the Phone

- Looking for Directions on the Phone

- Texting

- Applying Makeup

- Talking to a Passenger

- Looking for Something in the Glove Box

Out of the above, which is by no means an exhaustive list, perhaps the most serious issue is texting. Texting is an activity that initially seems fairly harmless. This is especially true if you are only responding to a “short” text. It is important to understand, however, that regardless of the length of time you spend texting, your eyes, hands, and mind are all removed from driving in the process.

What are the results of texting and other forms of distracted driving? Well, according to the National Highway Transportation Safety Administration (NHTSA), in 2015 alone 3,477 people driving while distracted ended up in a fatal accident or situation. Additionally, 67% of those victims were between the ages of 16 and 19.

Leading Cause of Death for Adolescents

According to numbers released by Allstate Insurance, one in two drivers said that they texted and drove. This comes from a poll conducted over three years (2013-2016) with 7,600 participants. Of those respondents, 76% also stated that they had either below average or average knowledge regarding the dangers of texting and driving. It should also be noted that as many as 66% of respondents also admitted to talking on the phone while driving. And while the majority of drivers surveyed admitted to distracted driving habits, even more actively disapprove of them, according to a poll funded by ATT: 95% of drivers surveyed disapproved of driving while distracted, but 71% of them also admitted to using smartphones while driving.

Why go into all of this? Well, distracted driving happens to be the leading cause of death for adolescents from the ages of 16 and 19. With so many people losing their lives at such a young age, it is important to really understand just how common distracted driving is, and how big the draw can be. Even amongst individuals who disapprove of it in theory, many of them are engaging in distracted driving behaviors.

In order to combat these distressing facts, let’s take a look at some risk factors that actually increase the risk of teen fatalities.

- Tailgating and Speeding

- Failing to Understand the Dangers of Driving

- Failing to Accurately Identify Dangerous Situations

- Not Wearing a Seat Belt

- Weekend Drives

- Drinking and Driving

It is important to keep the above in mind and make sure that your loved ones, of any age, understand the risk factors. This is perhaps especially true as, according to a Bloomberg study released in 2017, car accident fatalities are actually on the rise. It is suspected that the main cause of this is an increased rate of use of smartphones while driving.

Have you been injured while driving thanks to the distracted driving of another? The attorneys of Frederick & Hagle can help! Contact us today for a free consultation at 800.642.1227.

Is your Car Insurance Enough?

For many people, buying a car is one of the most important moments of their lives. Cars tend to equal freedom and independence, after all, not to mention a way to travel to work, school, family and friends. With that said, it should be noted that owning a vehicle is as much a responsibility as it is a boon to your lie. That means that there are things you must do in order to maintain your vehicle and protect yourself and others. One of the most important of these is ensuring that your insurance is sufficient.

What’s required in Illinois?

Every state has different rules regarding car insurance. In Illinois, there are two different kinds of insurance for motor vehicles that you are required to carry – body and liability coverage and property coverage. Body and liability cover is insurance that, as the name implies, covers deaths or injuries stemming from a car accident that you caused. Property insurance, on the other hand, covers things like damage to the property of another person involved in the accident, including things like the vehicle, yards, fences, personal items, and pets.

The state of Illinois only requires that you maintain the minimum of each kind of insurance coverage in order to remain in good standing with the law. That means that you must purchase the following:

- $20,000 in property insurance (for each accident that occurs)

- $25,000 in liability insurance that covers the death or injury of a single person

- $50,000 in liability coverage to cover fatalities and injuries (for each accident that occurs)

Make sure to speak with your insurance broker to ensure that you meet the minimum insurance requirements set forth by the state. Additionally, you must carry your proof of insurance on your person at all times. Without it, you are not fully complying with the law.

Optional vs. Necessary Insurance Coverage

It is important to keep in mind that simply complying with the state law means carrying the bare minimum in insurance, not actually purchasing enough to cover yourself in the event of an accident. To ensure you have adequate security against car accidents, consider investing in voluntary insurance policies like:

- Towing

- Collision

- Medical Payments

- Comprehensive

- Under-insured/Uninsured Motorist Coverage

Should you find yourself under-insured or uninsured, you could see your license suspended as well as be required to pay an expensive fine. You might also find yourself on the receiving end of civil penalties like a judgement finding you to be responsible for damages and injuries caused by the negligence you displayed when causing the accident in question.

How much insurance do I need?

As indicated above, the state minimums for auto insurance are $20,000 for property insurance, $25,000 for liability (injury or death), and $50,000 in liability (injury and fatalities), or 20/25/50. Most professionals will tell you that you should consider upping these amounts to 100/300/100, respectively, if you have a savings account and are in the middle class. Should you be wealthy and have more expensive assets, then consider investing in 250/500/100. What these higher coverage limits do is help protect your assets should you be found at fault for an accident.

Optional Policies and When to Consider Them

There are a number of optional policies that you can opt to add to your insurance policy. Under-insured motorist coverage, for example, is vital if you have no way to pay for medical care or damage done to your vehicle should you end up in an accident. If you have collision coverage and health insurance, this kind of policy is perhaps a bit more “optional”, but it is still an important one to consider as it helps keep your out-of-pocket expenses to a minimum.

Many people would prefer to avoid collision and comprehensive insurance policies because they are the more expensive additions. It is important to invest in them if your vehicle is ten years old or less, and especially if you have some kind of loan against the vehicle (in which case the lender in question will often dictate a minimum amount of collision/comprehensive coverage to maintain). This kind of optional policy is what helps pay for damage to your vehicle after an accident.

Finally, medical payment coverage is the policy that will help pay for your medical bills should you be injured in an accident. This is especially important if you have no health insurance or if your insurance is inadequate. While this policy addition can be pricey, that cost pales in comparison to the amount of money you could find yourself spending on medical payments should you be injured without it.

Remember that insurance only covers as much as you’re willing to pay for – and after the insurance runs out, you will end up paying for excess expenses. That money will come from your assets and finances. In order to help avoid this, make sure that you maintain adequate insurance coverage at all times.

If you or a loved one have been involved in a car accident, contact the experts at Frederick & Hagle today! We offer free consultations at 1.800.642.1227.